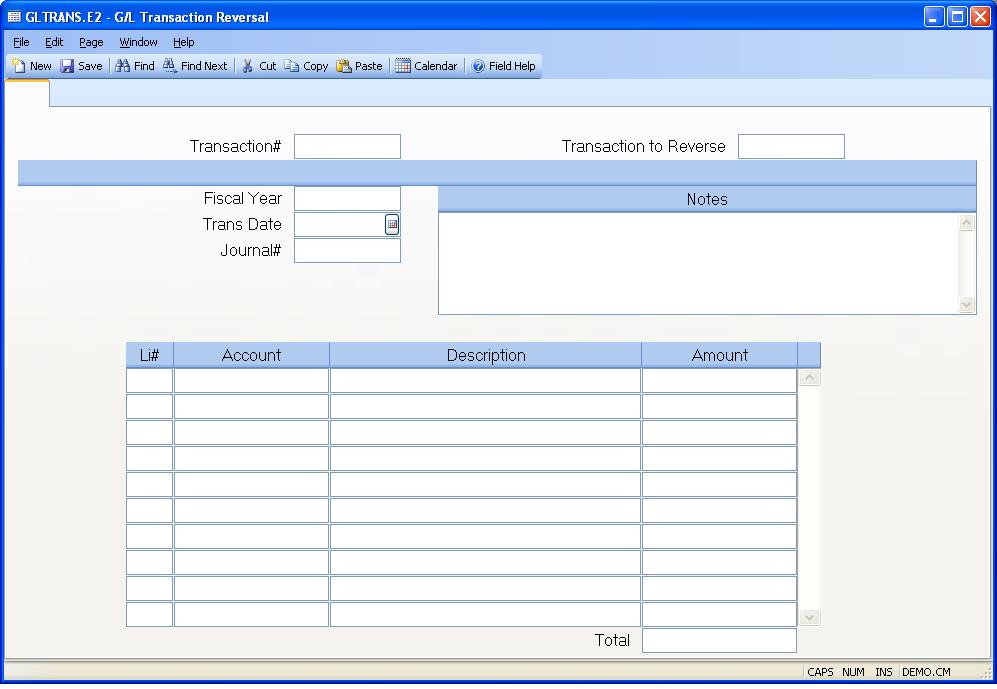

# G/L Transaction Reversal (GLTRANS.E2)

Read Time: 2 minute(s)

#

Gltrans ID To reverse an existing transaction, leave this field null and enter the transaction number in the next field. If the posting status is not set to post on-line, and you wish to modify an existing reversal, enter that number here.

Previous.id Enter the transaction number you wish to reverse. The transaction must exist on file and must have been previously posted. If it was not posted, you should use GLTRANS.E to modify the existing record. If found, the transaction will be loaded into the current screen, with all dollar amounts reversed. To completely reverse the prior tran- saction, simply file the record. You may, if you wish, make any other adjustments to this transaction once it has been loaded.

Fiscal year Enter the fiscal year into which this is being posted. This year must exist in the FY file and must not have been finally closed.

Date Enter the transaction date for this record. This date must be within the defined fiscal year already entered.

Journal # Enter the journal number. The journal number can be any user defined number up to 4 digits.

Desc Enter a description for this line entry. Multiple lines are permitted, so make it as detailed a description as you wish.

Line number Enter the line item number. This line item number identifies each account and amount which is part of this transaction. When filed, the numbers will be re-sequenced in case there have been any insertions or deletions prior to filing.

Account number Enter the account number for this line to which to dollar amount will be posted. The account number must exist on the GLCHART file.

Acct desc The account description is loaded from the GLCHART file automatically. This is for verif- ication only and cannot be changed.

Amount Enter the amount to be posted to the account number on this line. For credit amounts, enter them as a negative number (preceded by a minus sign "-"). Each time you enter a dollar amount, the balance field will be updated to help you keep track of the running balance. This balance must be zero to sucessfully file (and post) the record.

Balance Running balance of

Version 8.10.57