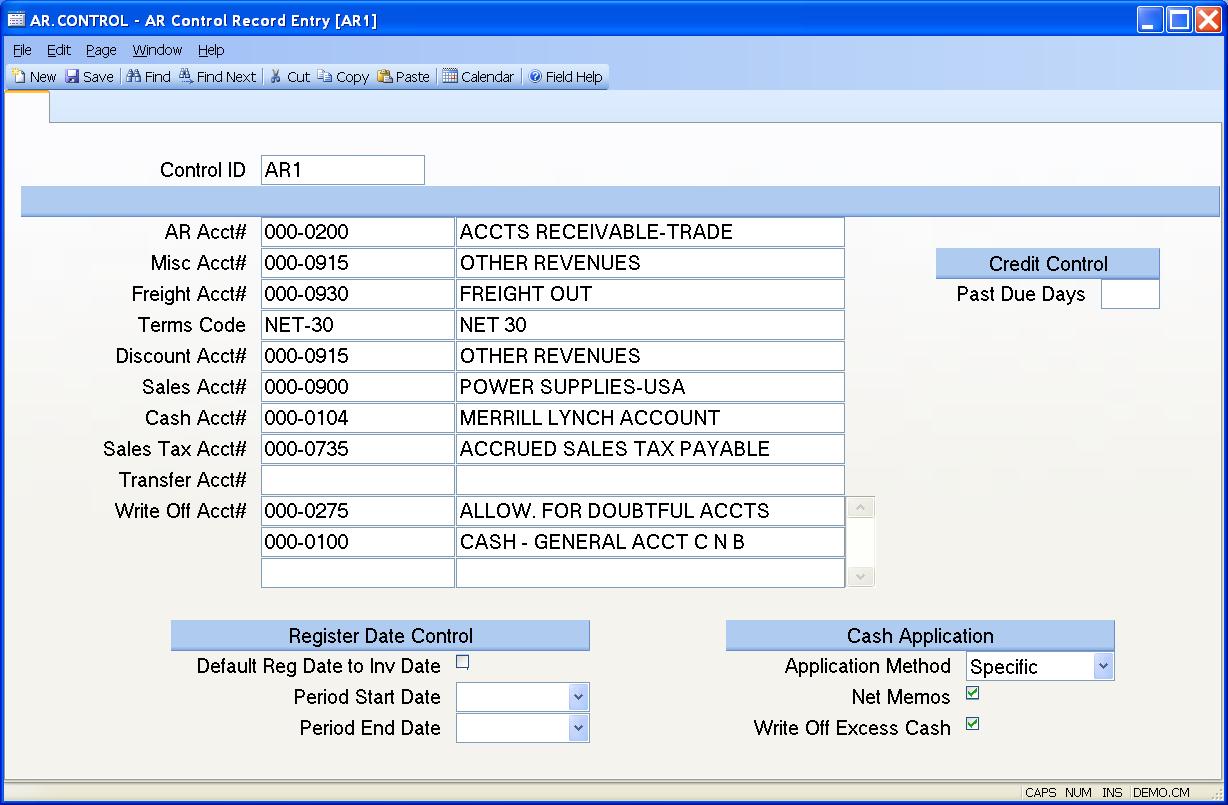

# AR Control Record Entry (AR.CONTROL)

Read Time: 5 minute(s)

#

Control.ID The control id is the company code (as defined on screen 2 of CO.CONTROL) preceded by "AR". If you only have one company code the control id will automatically be inserted into this procedure for you. If you have multiple company codes you may select from a list of available companies or you may enter the id directly e.g. AR3. This record contains the default information used in the AR module by company code.

AR Acct# This is the default Accounts Receivable account used by the AR.E procedure. This is loaded into the AR record automatically and can be changed as required.

Misc Acct# This field can be used to default an account number into the Miscellaneous Account field, after a Miscellaneous amount has been entered. This should be used when the account number is most often the same, thus saving data entry keystrokes.

Freight Acct# This field can be used to default an account number into the Freight Account field, after a Freight amount has been entered. This should be used when the account number is most often the same, thus saving data entry keystrokes.

Terms Code This field should contain a default terms code, which will be used in the AR module if a customer is used for which a terms code has not been previously defined.

Discount Acct# This field can be used to default an account number into the Discount Account field, after a terms discount amount has been entered or calculated. This should be used when the account number is most often the same, thus saving data entry keystrokes. This account number cannot be the same as the a/r trade account number.

Sales Acct# This field can be used to default an account number into the AR.E line item Distribution account field, after a Distribution amount has been entered. This should be used when the account number is most often the same, thus saving data entry keystrokes.

Cash Acct# This field can be used to default an account number into the Cash Account field in CASH.E .

Sales Tax Acct Enter the account number to be used for collection of sales tax. This field is used if sales tax has been charged and no valid account number was found in the STAX record.

Transfer Clearing Acct This field can be used to default an account number into the Clearing Account field in CASH.E5 .

Write Off Acct Enter the account number which may be used in CASH.E when an amount is being written-off. There are two options for entry into this field: 1. Enter a single account number and it will be used without prompting. 2. Enter a list of account numbers and the user will be prompted to select one.

Write Off Acct Description This field contains the description of the associated account number and is for reference only.

Past Due Days This field will control the credit check in sales order entry. This field is a system-wide control field. All customers, which do not have an overriding number of days specified, will use this number of days. If you wish to place orders on hold when the customer is 1 day past due on any of their invoices, enter 1. Enter 2 for 2 days past due, etc.

Default Reg Date In AR.E , the register date defaults to the current system date. If you wish to default the register date to the invoice date, then set this field.

Period Start Date This field is used to control the entry of dates in the AR module and in the shipping entry procedures such as ship.e and ship.e2 . When used in conjunction with the period end date, it can ensure that dates entered are within an acceptable range. This is especially helpful when used to keep from posting records into a previously closed period.

Period End Date This field is used to control the entry of dates in the AR module. When used in conjunction with the period start date, it can ensure that dates entered are within an acceptable range. This is especially helpful when used to keep from posting records into a future period.

Cash App Method Select the default application type which is to be used in the CASH.E procedure. This application method will automatically load and can be changed during the procedure as required. Select the method which is most often used. Options are:

Specific - Specific invoices

Oldest - Oldest invoice first

Range - User specified

Net Memos If, during CASH.E , one of the automatic apply methods are used, do you want to net credit memos and on account records during the processing of a range of AR items? If so, check this box.

Write off Excess Cash Check this box if you want to allow CASH.E to write off excess cash received instead of requiring it to be applied as an on-account item. If this is allowed, a message will be displayed upon filing the CASH entry to verify this when a positive balance remains. The write off account listed above will be used. If multiplie write off accounts are listed the user will be presented with the list to choose from.

AR Account Desc This field contains the description of the AR account number.

Misc Account Desc This field contains the description of the associated account number and is for reference only.

Freight Acct Description This field contains the description of the associated account number and is for reference only.

Terms Description This field contains the description of the associated terms coder and is for reference only.

Discount Acct Description This field contains the description of the associated account number and is for reference only.

Sales Acct Description This field contains the description of the associated account number and is for reference only.

Cash Acct Description This field contains the description of the associated account number and is for reference only.

Sales Tax Acct Description This field contains the description of the associated account number and is for reference only.

Clearing Acct Description This field contains the description of the associated account number and is for reference only.

Version 8.10.57