# Recurring AR Entry (ARR.E)

Read Time: 4 minute(s)

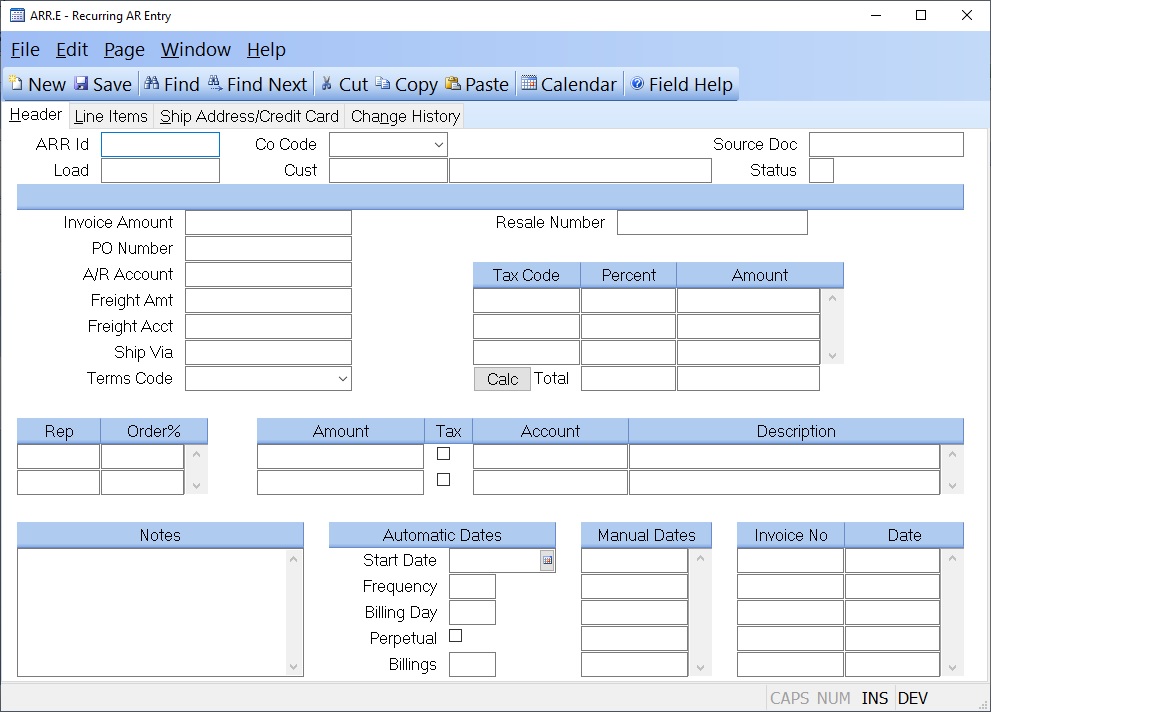

# Header

ARR Id If you wish to access an ARR record which already exists, enter that number. If you wish to enter a new ARR record, you may either enter a new ID now, or leave this field null to assign a new ARR ID when the record is filed.

Co Code Enter the company code the recurring invoices should be applied to.

Customer Enter the customer number who will be invoiced. The customer

number must exist on the

CUST file. Customer name will display to the right of prompt after entry for

verification.

Customer Name This is the customer name as read from the CUST file.

Source Doc Enter the source document number which generated this recurring AR item.

Status This is a system controlled field indicating the status of this ARR item: O = Open C = Closed /

Inv Amount Enter the net amount of the invoice. This is the actual amount

owed by the customer. The amount entered here must equal:

Total of all line item amounts

+ Miscellaneous amounts

+ Freight

PO# Enter the purchase order number against which this ARR record is being entered. This is an optional field.

AR Acct# Enter the G/L account number against which the AR records will be charged. This account number is defaulted from the AR.CONTROL file and can be changed if necessary.

Freight Amt Enter the freight amount which is being charged on this invoice.

Freight Acct# Enter the G/L account number to which the freight amount is being charged.

Ship Via Enter the designation for the shipping method to be used.

Terms Code Enter the terms code which identifies the terms to which the customer agreed. This is defaulted CUST file and can be changed as required.

Resale# Enter the resale number for the customer if any items are non- taxable.

Rep Enter the number of the Rep which gets credit for all AR items generated. This field is associated with the Order Pct field which follows.

Order% Enter the percent of each order which will be credited to the associated Rep. This field can be used for splitting orders between multiple Reps.

Tax Code The sales tax code to be used for this item. This field is originally loaded from the customer file and may be changed as necessary.

Tax Pct The sales tax percent, as read from the STAX file.

Tax.Amt The amount of sales tax for the associated sales tax code.

Tax Rate Enter the tax rate to be applied to all AR records created.

Total Sales Tax The total amount of sales tax for this record.

Misc Amounts Enter any miscellaneous amounts which have been added to the

invoice. This field is

multi-valued and can contain any number of amount, associated with the

miscellaneous

descriptions and account numbers.

Misc Taxable Check this box if the associated miscellaneous charge is taxable.

Misc Acct# Enter the account number to which the miscellaneous amount is being distributed.

Misc Desc Enter a brief description of the charge(s) being added to the invoice.

Notes Enter any notes which apply to this ARR item.

Start Date Enter the first date on which an AR record is to be created. This entry will be affected by the day number entered in the Billing Day field. For example, if you enter 03-12-2006 in this field but specify the billing day as 1 your first billing will actually occur on 04-01-2006. It will always occur on the first billing day after the date specified.

Frequency Enter the number of months between each billing. For example, if you wanted to bill quarterly you would enter 3. For twice yearly you would enter 6. If no entry is made then 1 is assumed.

Day Enter the day of the month on which the AR record is to be generated from this recurring record. For example, if you want to generate an invoice on the 10th of each month, enter 10 here.

Perpetual Check this box if billings are to continue indefinitely. Otherwise, enter the number of billings to be done in the Billings field.

Number ARs Enter the number of times this recurring record should create an AR record. For example, if this record is being entered to generate a monthly bill over the course of a year, enter 12. Leave this field blank if you have checked the Perpetual check box.

Manual Dates If you do not use the automatic option you may specify the dates manually by entering each date on which you want a billing to be generated. If there are entries in this field they will take precedence over the automatic option settings. Even after the dates in this field have been exhausted the automatic settings will not be used.

Invoice No These are the Invoice record Id's which were created for this recurring record, on the dates listed.

Invoice Date Displays the date on which the invoice was created by the ARR.P1 process.

Calc Click this button to calculate the tax rate for the address entered on the Ship Address page.

Version 8.10.57