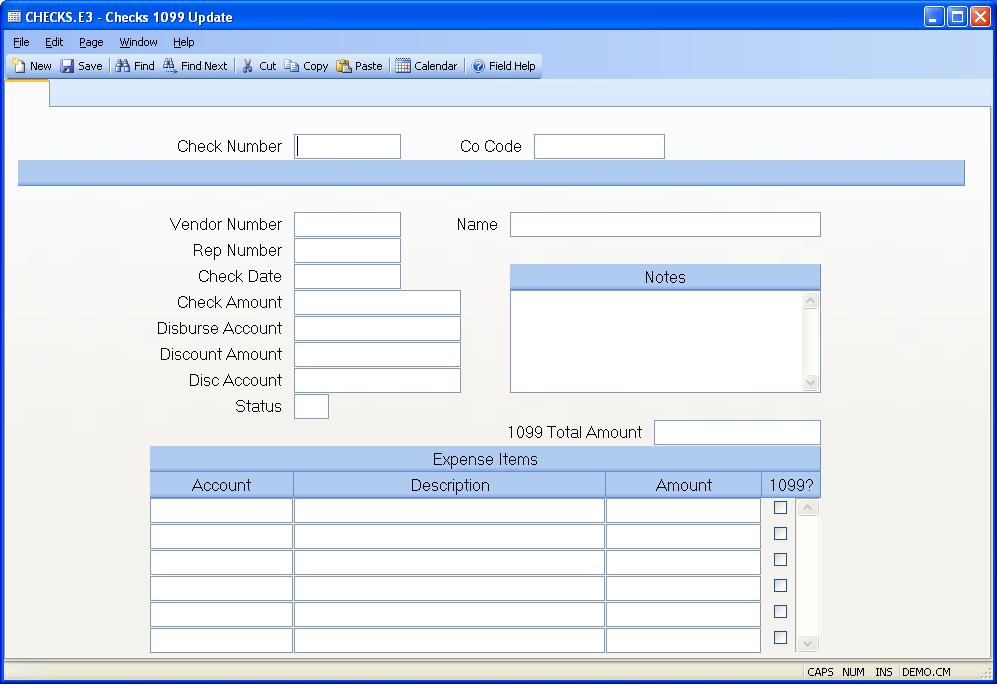

# Checks 1099 Update (CHECKS.E3)

Read Time: 1 minute(s)

#

Check# Enter the check number which you want to update for notes or 1099 data.

Co.Code The company code for this check.

Vendor# The vendor number to which the check is being paid.

Name The name of the vendor or rep to which the check is being paid.

Rep Id The rep number to which the check is being paid.

Check.Date Enter the date which appears on the check.

Check.Amt The amount for which the check was issued.

Disb.Acct# The G/L account number from which this check is being paid.

Disc.Amt The amount of discount which was taken on this check.

Disc.Acct# The G/L account number which is being credited for the discount amount.

Status The status of this check record. P = Posted V = Void S = Stop Payment C =

Notes Enter any notes applicable to this check.

Amount for 1099 This is the total expense amount flagged for 1099 reporting as recorded in the 1099 file. It is based on the amounts flagged below and/or the vendor and rep 1099 settings. If the 1099 amount needs to be manually adjusted, enter the new amount here. This amount will be recorded on the 1099 file for the year. The 1099 file must be generated before this amount can be adjusted.

Expense Acct The expense account for the associated amount.

Acct.Desc This field contains the description of the GL account.

Expense Amt Enter the expense amount for the associated account number.

1099 Check here if this expense item will be included in 1099 reporting for the vendor or rep. If this check number is not related to a vendor or rep number, then this box cannot be checked.

Version 8.10.57