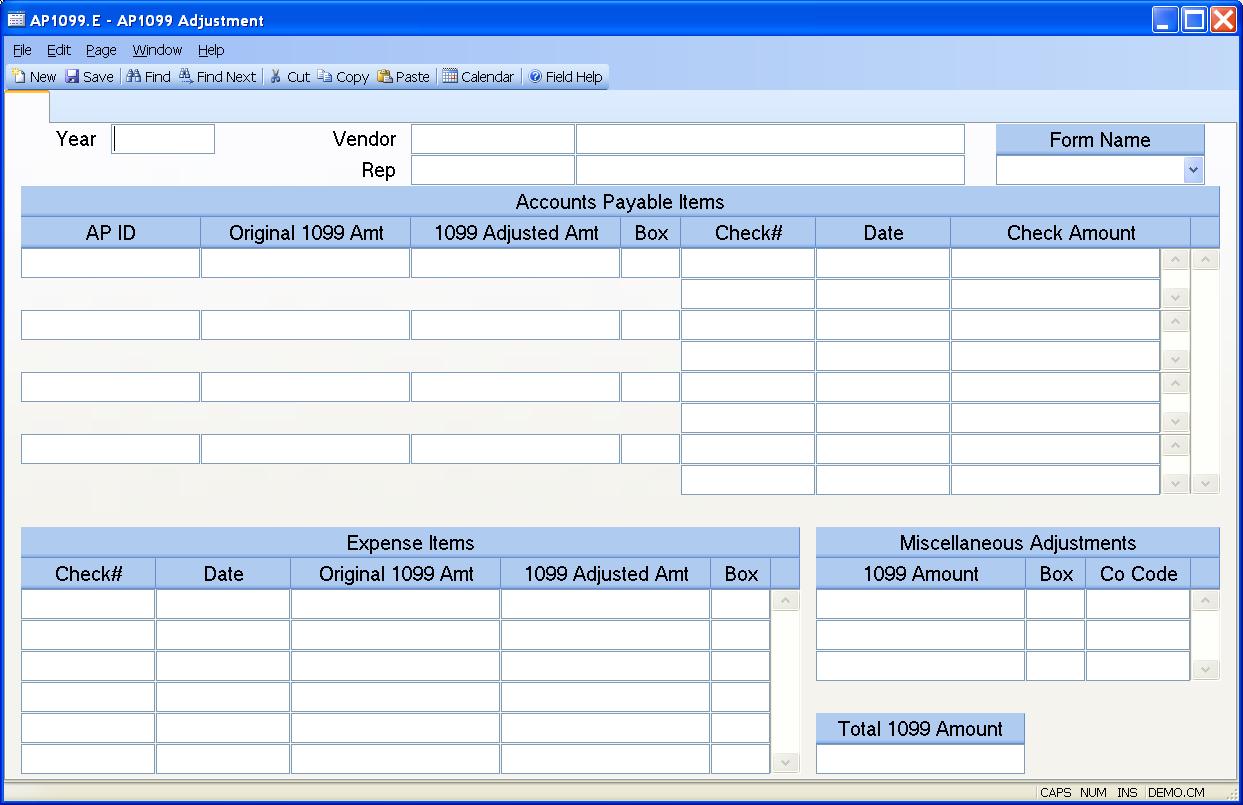

# AP1099 Adjustment (AP1099.E)

Read Time: 3 minute(s)

#

** ** The record ID will be programmatically assigned based on year and vendor/rep entry.

Year Enter the year for updating the 1099 file. This must be entered as a four digit year.

Vendor Enter the vendor number you wish to update.

Rep Enter the rep number you wish to update.

Vendor Name The vendor name.

Rep Name The rep name.

Form Name Enter the form that should be used when printing the 1099 for this vendor or rep. If no entry is made in this field, it is assumed that the 1099-MISC form should be used. The AP1099.F1 and AP1099.F2 procedures are used to print the 1099-MISC forms and will exclude any records that have a form of 1099-INT entered in this field. The AP1099.F3 procedure is used to print the 1099 interest forms and will only include records with a form name of 1099-INT.

Ap Id The accounts payable ID.

AP Pay Amt The original 1099 amount for the AP item as calculated from the check payments and the 1099 flag specified when AP.P7 was run. This is shown for information only and cannot be changed.

Ap 1099 Amt Adjusted This will originally be equal to the 1099 amount in the previous prompt. If you want to manually override the amount, change this entry. Warning! Rerunning AP1099.P1 will override this entry.

AP 1099 Box This is the 1099 form box number from the AP record. You may change this box number here if needed. Warning! Rerunning AP1099.P1 will override this entry.

Ap Check Id These are the check numbers for the associated AP item that were issued during this 1099 year.

Ap Check Date The check date.

Ap Check Amt The check amount. This is shown for information only and cannot be changed.

Misc Check Id These are the check numbers for miscellaenous expense items or rep commission checks that were flagged for 1099.

Check Date The check date.

Check 1099 Amt The original 1099 amount for the check as calculated from the 1099 flag specified when AP.P7 was run. This is shown for information only and cannot be changed.

Check Adjusted 1099 Amount This will originally be equal to the 1099 amount in the previous prompt. If you want to manually override the amount, change this entry. Warning! Rerunning AP1099.P1 will override this entry. This can also be modified in CHECKS.E3 .

Check 1099 Box This is the 1099 form box number from the Vendor or Rep record. You may change this box number here if needed. Warning! Rerunning AP1099.P1 will override this entry.

Misc Amt If you wish to adjust the total 1099 amount that has been calculated from the accounts payable and/or checks, enter the adjustment amount here. This box can be used to enter an amount that was paid to a vendor out of another software package and is not being reported in M3. Warning! Rerunning AP1099.P1 will override this entry.

Misc 1099 Box Enter the box on the 1099 form that the money should be reported against. If this is left empty, the non employee compensation box will be used. Warning! Rerunning AP1099.P1 will override this entry.

Misc Co Code Enter the company code that should be applied to this adjustment. Warning! Rerunning AP1099.P1 will override this entry.

Total 1099 Amount This field contains the total 1099 amont that will be reported for the above vendor/rep for all company codes. This is a calculated amount and cannot be changed. Warning! Rerunning AP1099.P1 may cause this amount to change.

Version 8.10.57