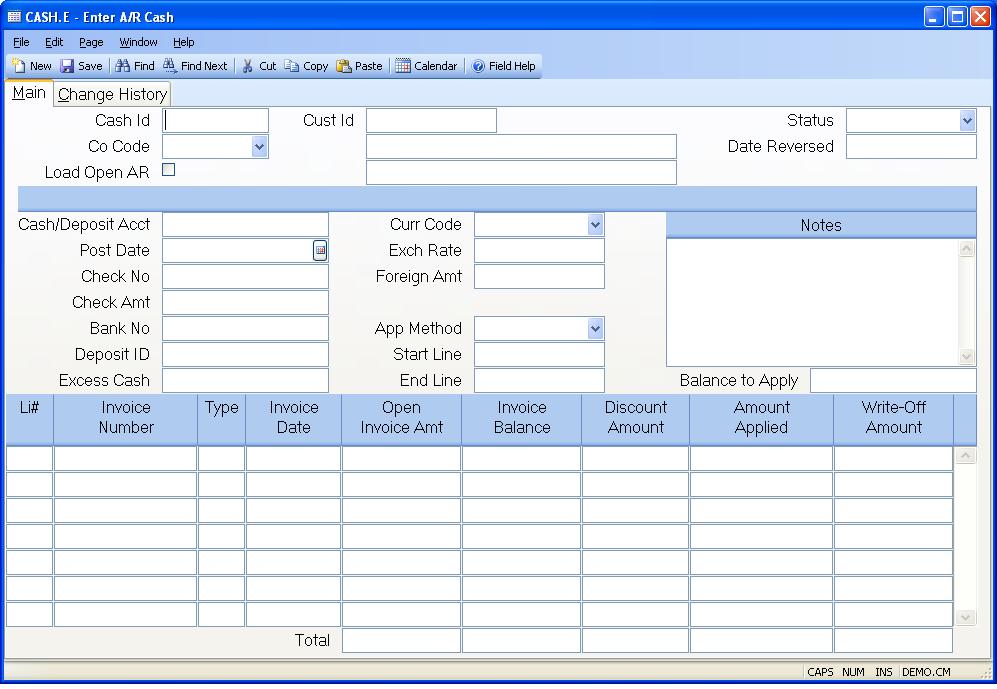

# Enter A/R Cash (CASH.E)

Read Time: 7 minute(s)

# Main

Cash Id This is a sequentially assigned number used to identify the cash batch you are entering. The number will be assigned and displayed when the record is filed. To review a previously posted cash record, enter the cash number.

Co Code Enter the company code the check was issued for. Payment can only be applied for A/R records with a matching company code. The company code must be pre-defined in the CO.CONTROL procedure.

Load Open AR Check this box load all open AR items for the customer selected.

Cust Number Enter the customer number who is making the payment. If you do

not know the customer's

number, there is an option in the help menu for this prompt which allows you

to select the

customer by name.

Cust Name The name of the customer, as read from the CUST file.

Address This portion of the address is used to verify you have selected the proper customer.

Status On existing records, the status of the transaction will be displayed in this field. This field cannot be updated manually.

There is a lookup option available from this field to display the recon id that the deposit was cleared against.

Reverse Date If the cash transaction was reversed, the date it was reversed on will appear in this field.

Cash Account Enter the General Ledger account number to be debited for the cash amount. This number will default from the AR Control record and can be over-ridden if required. This field may be changed on records with a status of POSTED. This field cannot be changed on records that have been cleared or reversed. Changing the date will cause an update to the general ledger. Therefore, both the original and new post dates must fall in an open fiscal period.

Post Date Enter the transaction date which should indicate when the payments were applied. This date will be used to calculate any discounts which should be allowed. This field may be changed on records with a status of POSTED. This field cannot be changed on records that have been cleared or reversed. Changing the date will cause an update to the general ledger. Therefore, both the original and new post dates must fall in an open fiscal period.

Check Number Enter the number from the check which the customer is using to make the payment. If you are not applying a check, but are 'netting' invoices, enter any code you wish which will indicate what you are doing. If required, the check number is one of several fields that can be changed on existing records.

Check Amount Enter the net amount (face value) of the check. This is the actual amount of money being applied.

Bank Number Enter the bank number for this cash transaction. This number will print on the deposit slip form , CASH.F1 . If required, the bank number is one of several fields that can be changed on existing records.

Deposit.ID This field is used to assign a "deposit batch" number to a series of cash entries. These cash entries may then be reported as a group. Deposit slips may, also, be printed via CASH.F1 . If you will be using RECON.E to reconcile your bank statements, a deposit id is recommended. If required, the deposit id is one of several fields that can be changed on existing records.

Currency Code If this cash receipt is in a foreign currency, enter the currency code here. That will load the exchange rate defined in CURRENCY.CONTROL .

Exchange Rate This is the exchange rate associated with the currency code as defined in CURRENCY.CONTROL . It can be changed as needed.

Foreign Amount If this cash receipt is in a foreign currency, enter the foreign check amount here. Based on the exhange rate above, the domestic currency check amount will be calculated.

App Method Select the method the check amount is to be applied to

invoices:

Specific - Apply amounts to specific invoices

Oldest - Apply to oldest invoice first

Range - Apply to a range of

Start Line Item If application type "Range" was selected, enter the starting line item to be used for the range.

End Line Item If application type "Range" was selected, enter the ending line item to be used for the range.

Balance This is a running balance for this Cash record. It displays the amount of the check yet to be applied.

Li# Enter a line item number which will uniquely identify each invoice being paid. This will be a sequential number. This field (and all associated data) will automatically be loaded if the user opted to load all customer data. Additional lines may be added to create credit and/or debit memos.

AR Id The record ID in the AR file of the item being paid. This can be an invoice, credit memo or an on-account record. To create new credit/debit memos, either leave this field empty or enter a number which does not currenty exist on the AR file.

Type This is the AR type: IN - Invoice CM - Credit Memo DM = Debit OA - On

Inv Date The invoice date from the AR record.

Open Invoice Amount This field contains the open amount left on the invoice. This field is displayed for reference and cannot be changed.

Inv Balance The balance of the AR item after the discount, applied and write-off amounts have been applied.

Disc Amount The discount amount being allowed for this invoice, based upon the terms entered on the invoice and the invoice due date. This amount is automatically defaulted, but can then be changed as required. There is a lookup option from this field to display the g/l account number that the discount amount was applied to.

Amount The application amount for this transaction. This field will default to the invoice balance, less discount, provided that the check running balance is sufficient. If not, this amount will default to the remainder of the running balance. To create new credit and/or debit memos, enter the desired amount in this field. For credit memos, enter the number as a positive number.

Write Off Amount The amount of the invoice on this line which should be written off because payment will not be received from the customer. This amount should not be included in the check amount. Example: There are two open invoices for a $100.00 each for the customer. You receive a check for $100.00 for one of the invoices and you agree to write off the second invoice. For the invoice that will be paid, a $100.00 should be entered in the AMOUNT APPLIED field. For the invoice that will not be paid, a $100.00 should be entered in the WRITE-OFF AMOUNT field. The check amount should be for $100.00 not $200 since $100 is the amount that will be deposited into the bank/cash account.

On existing records, there is a lookup option from this field to display the g/l account number the the write-off amount was applied to.

Total Open Amount The total open amount for all invoices.

Tot Inv Balance The total of all the invoices listed in this column.

Tot Disc Amount The total of all discount amounts allowed.

Total Amount The total of all applied amounts entered.

Total Write Off The total of all write offs entered.

Notes Enter any notes desired. If required, the notes are one of several fields that can be changed on existing records.

Excess Cash An amount will only appear in this field on existing records if excess cash was received from the customer. Entries cannot be made into this field on new transactions. There is a lookup option from this field to display the g/l account number that the excess cash was applied to.

Version 8.10.57