# Vendor Entry (VENDOR.E)

Read Time: 5 minute(s)

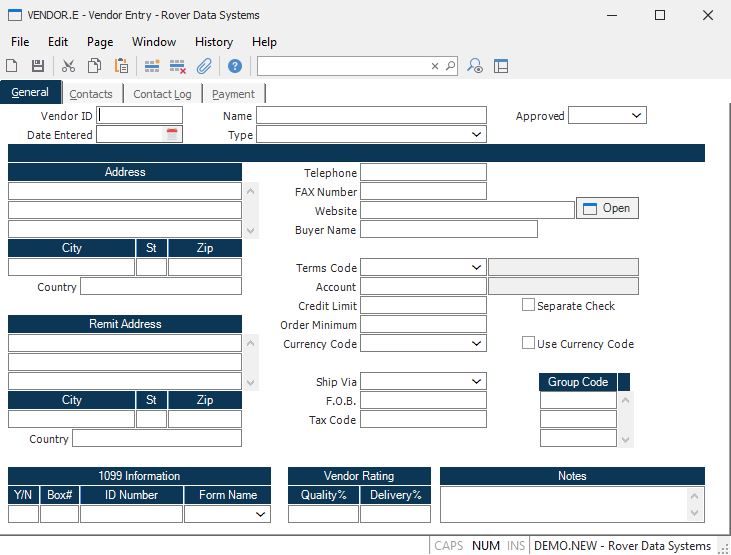

# General

Vendor ID Enter the number which identifies the vendor you wish to add or change. If you wish to have the system assign the next sequential number, leave this field null. If you want to access an existing vendor record but do not know the vendor's number, there is an option in the help menu for this prompt which allows you to select a vendor by entering the vendor's name.

Date Entered This is the date the vendor was entered. It will default to the system date for new vendors.

Name Enter the name of the vendor described in this record.

Type Select the type that best defines this vendor.

Approved If this is an approved vendor, enter 'Y' in this field.

Address Enter the street address for this vendor. Do not include the city, state, or zip. Enter those in the adjacent separate fields. The street, city, state, zip, and country will be combined for printing purposes.

City Enter the city portion of the address information.

State Enter the state portion of the address information.

Zip Enter the zip code portion of the address information.

Country Enter the country portion of the address information.

Remit Addr Enter the street address to use when making payments to this vendor. If this address is the same as the vendor's primary address then leave this field blank. You may enter up to 4 lines of text.

Remit City Enter the remit-to city that is to be printed on the check for this vendor.

Remit State Enter the remit-to state to be printed on the check for this vendor.

Remit Zip Enter the remit-to zip code to be printed on the check for this vendor.

Remit Country Enter the remit-to country to be printed on the check for this vendor.

1099.Flag If this vendor requires 1099 reporting, enter a "Y", otherwise enter either an "N" or leave null.

1099 Box Enter the box on the 1099 form which is to used to print forms for this vendor. This field will be used as a default into the AP.E procedure. If this field is left empty the non-employee compensation box is assumed.

ID.Number Enter the vendor's payer ID number. This may be a social security number in the case of a sole proprietor or individual, or a federal tax ID.

Quality Weight% Enter the percentage to be applied to quality performance when rating the overall performance of the vendor. For example, you may want to place a higher percentage on delivery for distributors since they are not directly responsible for quality issues. A vendor that manufactures the items it delivers might need more emphasis placed on the quality factor in the rating. If no entry is made in this field, the qualtity percentage entered in DMR.CONTROL will be used.

Delivery Weight% Enter the percentage to be applied to delivery performance when rating the overall performance of the vendor. For example, you may want to place a higher percentage on delivery for distributors since they are not directly responsible for quality issues. A vendor that manufactures the items it delivers might need more emphasis placed on the quality factor in the rating. If no entry is made in this field, the delivery percentage entered in DMR.CONTROL will be used.

Telephone Enter the telephone number for this vendor. The suggested format is XXX/XXX-XXXX.

FAX Number Enter the number to use for sending a fax to this vendor. The suggested format is XXX/XXX-XXX.

Website Enter the URL for the vendor's website.

Buyer Name Enter the name of the buyer who normally deals with this vendor. There is a help lookup to display buyers.

Terms Enter the terms code which defines the method of payment normally used by this vendor. The terms code must have been previously entered in the terms file.

Terms Desc Contains the description of the terms in the previous field. This information is loaded from the TERMS file for reference only and may not be changed.

Account Enter the General Ledger account number assigned to this vendor. A valid account number entered here will default into the PO.E and AP.E screens.

Account Desc This field contains the description of the GL chart of account.

Credit Limit Enter the credit limit your company has with this vendor.

Sep Check Check this box to default each AP item to be paid on a separate check, rather than grouping it with other AP items for the same vendor.

Order Minimum If applicable, enter the minimum amount a purchase order can be taken for this vendor. If a purchase requisition is entered in POREQ.E or a purchase order is entered in PO.E for an amount that is less than this amount, a warning message will be issued.

Currency Code If applicable, enter the currency code for this vendor.

Use Currency If this box is checked, the currency code entered on this screen will be loaded into new purchase orders and AP records. If this box is checked and no currency code is entered, the check mark will be removed when the record is saved.

Ship Via Enter the method of shipment normally used with this vendor. You would normally enter the name of a carrier or preferred method of shipment.

F.O.B. Enter the F.O.B. point normally used by this vendor.

Tax Code Enter the tax code for this vendor. This will be defaulted into the purchase orders placed with this vendor and sales tax will be calculated and added to the AP records based on this tax code rate from the PTAX file.

EPayment ID If you are using an electronic payment capability, this is the vendor's unique identifier for the service provider. For the Paymode-X service provider it is also called "12.12".

Notes Enter any notes applicable to this vendor.

Open Click here to open this website.

Version 8.10.57