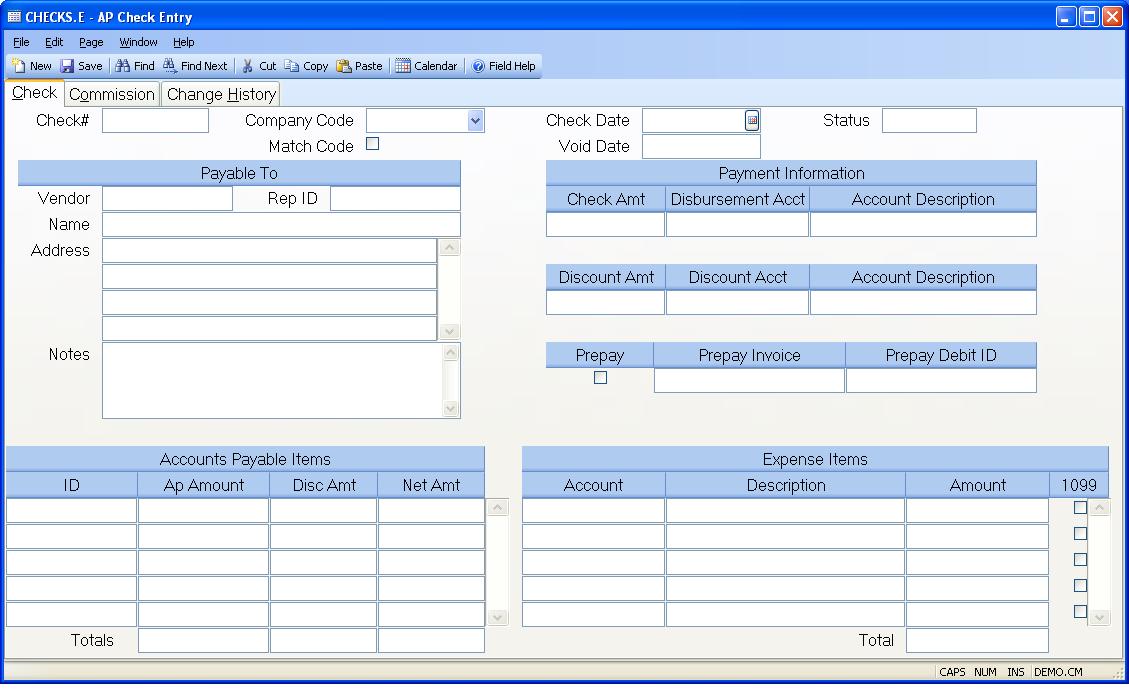

# AP Check Entry (CHECKS.E)

Read Time: 5 minute(s)

# Check

Check# Entering Regular Checks:

Enter the number of the hand check which you are logging into the system. As

checks should already have been manually prepared, you must enter a check

number. If you enter a number of a check which already exists on file, the

only option you will have is to delete that check. No changes are allowed to

an existing check record, for audit purposes.

Applying Prepayments:

Enter the letter "A" in the check number field. This will indicate that you

are entering a zero dollar check record for the purpose of applying

prepayments or other debit AP's against invoices. You must enter AP ID's that

sum to zero. The expense section must be left blank.

Upon filing, a sequential number will be created for the zero check, prefixed

with "A".

Company Code Enter the company code for this check. The company code must be pre-defined in the CO.CONTROL procedure. If only one code exists, it will automatically be inserted into this procedure for you.

Match Co Code Check this box if the company code posted to the a/p records needs to match the company code entered in this procedure.

Check Date Enter the date which appears on the check.

Void Date The date this check was voided. It is displayed here for reference only and cannot be changed.

Status Displays the current status of the check. This may be one of the

following:

Posted - Check has been created and posted.

Voided - Check has been voided.

Stopped - Payment on the check has been stopped.

Cleared - Payment has cleared the bank.

There is a lookup option available from this field to display the recon id that the check was cleared against.

Display Register History

Vendor# Enter the vendor number to which the check is being issued. If this is for a one-time or miscellaneous vendor, leave this field null. If left null, the A/P records will not be entered. This feature is useful for logging non-AP related checks. If you do not know the number of the vendor, there is an option in the help menu for this prompt which allows you to select the number by entering the vendor's name. f the vendor is flagged for 1099 reporting, the 1099 flag will be defaulted for each expense amount entered.

Rep Id If this check is for a rep instead of a vendor, enter the rep ID here. If the rep is flagged for 1099 reporting, the 1099 flag will be defaulted for each expense amount entered.

Name Enter the name of the vendor for which you are creating a check. If this field is left blank and there is a vendor number present, the name in the vendor file will be used.

Address Enter the address of the vendor for which you are creating a check. If this field is left blank and there is a vendor number present, the address in the vendor file will be used.

Notes Enter any notes applicable to this check. The first line, up to 16 characters, will be printed on the check stub.

Check.Amt Enter the amount for which the check was issued. This is the actual amount paid by the check. If there is a discount amount being applied, this amount will be the total of the AP items being paid, less the discount amount entered.

Disb.Acct# Enter the G/L account number from which this check is being paid. This account number is defaulted from the AP.CONTROL record and may be changed if desired.

Disb Acct Desc

Disc.Amt Enter the amount of discount which was taken on this check. This is the total discount for all AP items being paid.

Disc.Acct# Enter the G/L account number which is being credited for the discount amount. This is defaulted from the AP.CONTROL file and may be changed if desired.

Disc Acct Desc

Prepay Check this box if this is a prepayment check. Prepayments will create a debit record in the accounts payable file to indicate that a prepaid amount is available for application against future, or current invoices.

Invoice No This invoice # is used for prepayments. It will be loaded into the invoice number field of the AP debit record created.

Debit Id For prepayment checks, this is the debit AP ID created as a result of the prepayment. It is shown for information only, and cannot be changed. If this check has been subsequently voided, then this debit ID will be deleted from the AP file.

AP.Ids Enter the AP records which were paid by this check. This field is associated with the AP amounts field. If you wish to load all open AP items for this vendor, press the help key. Only 13 invoices may be entered for a single hand check entry.

AP.Amounts Enter the amounts for each AP record which is being paid by this check. The amount which defaults in this field is the balance of the AP item. This may be changed to an amount less than the balance, but never greater. If the AP item being "paid" is a debit memo, the amount is entered as a negative number.

AP Disc Amts

Net Amount This field contains the net amount that will be paid on the invoice. The net amount is the AP amount minus the discount amount. This field is displayed for reference only and cannot be changed.

Total AP The total amount of the AP items specified. This is used to display the running total of the items being paid.

Expense Acct If you are paying non-AP related expenses, enter the expense account to which you wish to distribute amounts.

Exp Acct Desc This field contains the description of the GL account.

Expense Amount Enter the expense amount for the associated account number.

1099 Check here if this expense item will be included in 1099 reporting for the vendor or rep. If this check number is not related to a vendor or rep number, then this box cannot be checked.

Total Misc Amount This field is the total of all of the expense amounts listed above.

Total Ap Disc Amount The total discount amount for all accounts payable invoices. This amount cannot be greater than the discount amount entered for the check.

Total Net Amount This field contains the total amount to be paid for these invoices. This total plus the total of the expense items should equal the check amount.

Version 8.10.57