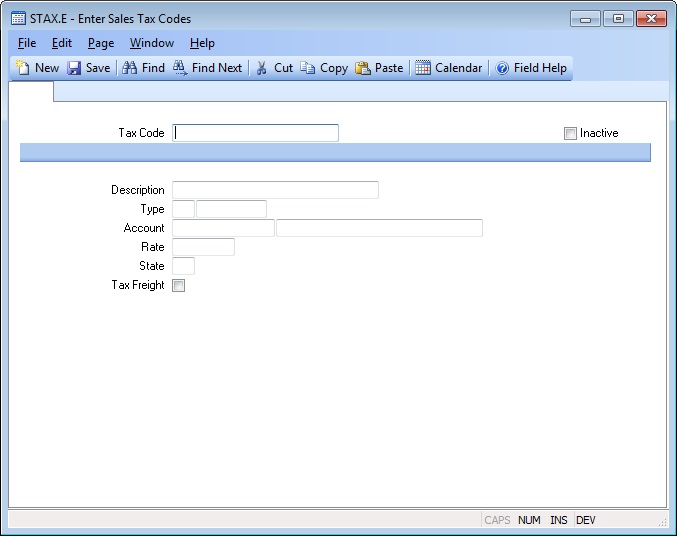

# Enter Sales Tax Codes (STAX.E)

Read Time: 1 minute(s)

#

Id Enter the sales tax code which you are defining (e.g. BART, OCTA, etc.)

Desc Enter the description of the sales tax code being entered. This is a free-form field which will be displayed when the tax code is entered elsewhere in the system.

Type Enter the type of tax code this represents (e.g. 'S' for state, 'L' for local, 'O' for other). This field is for reference only and has no impact on any calculations or reports.

Account Enter the general ledger account number which corresponds to the sales tax code. This account number will be used when updating the register files.

Rate Enter the sales tax rate for this sales tax code. The rate may be entered with up to four (4) decimal places. Enter all percentages as whole numbers (e.g. 7.0000 for 7%)

State Enter the state code for this sales tax record.

Type Desc This field describes the type code entered. This is a system controlled field.

Account Desc The description of the general ledger account number as it appears in the GLCHART file.

Tax Freight Check this box if freight is taxable for the state associated with this tax code.

Version 8.10.57