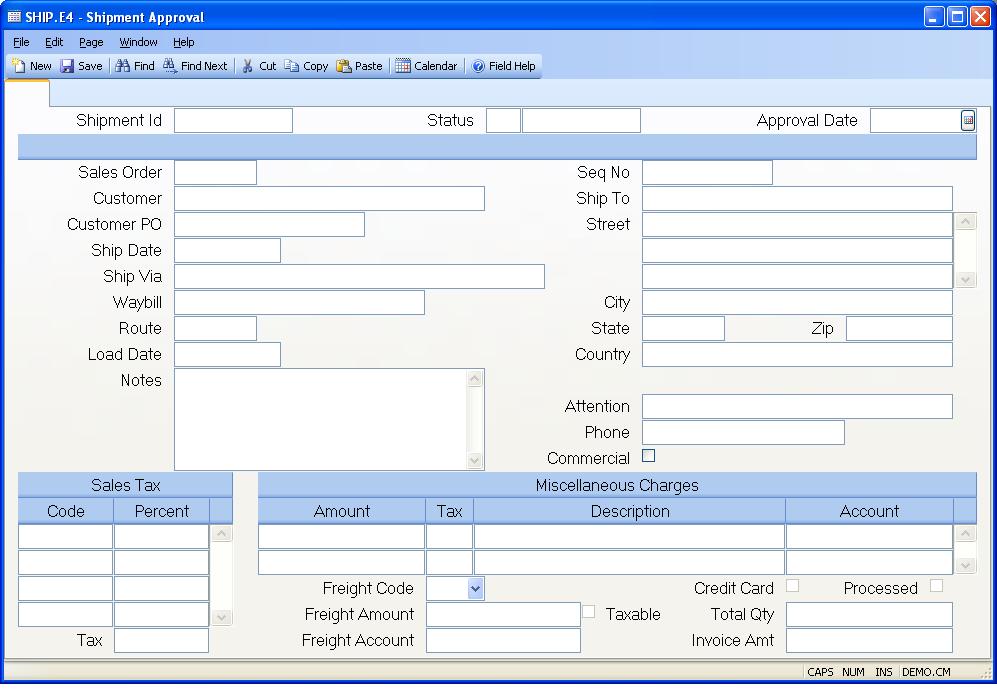

# Shipment Approval (SHIP.E4)

Read Time: 6 minute(s)

#

Shipment Number Shipment numbers are assigned automatically by the system when the record is filed. If you are creating a new shipment you should leave this prompt blank. If you want to make a change to an existing shipment you should enter the full shipment record ID. The ID of a shipment record is made up of the sales order number followed by a sequential number maintained for each sales order. For example, the first shipment for sales order 123 would be 123-1, the second 123-2 etc.

Status The status field contains the current status of the shipment

record. It will display one of the following codes:

N - The items have not been shipped.

S - The items have been shipped.

P - The shipment has been posted and the accounts receivable record has been

created.

If the status code is not already set to "P" then the user may enter the code "N" for new, or "S" for shipped. The "N" status sets the shipment as a new shipment just as the SHIP.E procedure does, and does not create any inventory transactions. The "S" status will confirm the shipment by creating inventory transactions, and will be posted the next time the procedure SHIP.P1 is run. Once the status has been set to "S" and the record has been filed, you may not reset the status to "N".

Approve Date This field contains the date on which accounting approved this shipment.

Sales Order# Enter the sales order number from which this shipments will occur. This must be a valid sales order.

Customer Contains the name of the customer assigned to the sales order. The customer name is displayed for information only and may not be changed.

Customer PO# Contains the customer purchase order number. The purchase order number is displyed for information only and may not be changed.

Ship Date Enter the date the shipment actually occurred or enter the date on which it is planned to occur. The system will default the current date.

Ship Via Enter the method of shipment or carrier to be used for shipping the items. This data is loaded from the sales order, but can be changed if desired.

Waybill# Enter the number of the waybill which will accompany the shipment.

Route# The shipment route that this shipment will be delivered on as defined by ROUTESHIP.E . It is displayed here for information only.

Load Date The route's load date for this shipment as defined by ROUTESHIP.E . It is displayed here for information only.

Notes Enter any notes which pertain to the entire shipment. These notes will print on the shipment form.

Ship Seq No Contains the shipping sequence number define in cust.e . If present this number will default in for you from so.e but can be changed as required. There is a right click option to display all shipping addresses available for this customer.

Ship Name Enter the name of the company the shipment will be sent to.

Ship To Address Contains the ship to name and address as shown on the sales order. This data is defaulted in from the sales order record and may be changed as required.

Ship City The city the shipment is being delivered to.

Ship State The state the shipment is being delivered to.

Ship Zip The zip code the shipment is being delivered to.

Ship Country Enter the country this shipment will be sent to.

Ship Attn Enter the name of the person or contact that this shipment is being delivered to.

Ship Phone The phone number associated with the ship address.

Commercial? Check this box if the shipment is being sent to a commercial address.

Tax Codes Enter the sales tax code(s) to be used for this shipment. These codes are originally defaulted from the sales order. They are reloaded if a different ship address is selected from the customer ship to address list. They may be changed manually, as required.

Tax Pcts Displays the tax percentage for the associated tax code.

Tax Rate The total sales tax rate.

Misc Charge Amount The miscellaneous charges field allows you to specify additional charges to be billed to the customer for the shipment. Charges are defined by entering the amount in this field followed by a description of the charge and the general ledger account number in the two fields which follow. You may enter as many miscellaneous charges as needed.

Misc Taxable If the corresponding miscellaneous charge is taxable, enter 'Y'. If it is non-taxable, enter "N" or leave this field empty.

Misc Charge Description Enter a one line description of the associated miscellaneous charge.

Misc Charge G/L Acct# Enter the general ledger account number associated with the miscellaneous charge.

Freight Code Enter the letter "P" if the freight charges for the shipment are being prepaid. Enter "C" if the charges are to be collected from the customer by the carrier.

Freight Amount Enter the dollar amount of any freight charges to be billed to the customer for the shipment.

Freight Account# If a freight amount is entered the general ledger account number associated with it should be entered in this field. The account number is defaulted initially from the MRK.CONTROL record.

Status The status field contains the current status of the shipment

record. It will display one of the following designations.

New - The items have not been shipped.

Confirmed - The items have been shipped.

Posted - The shipment has been posted and

the accounts receivable record has

been created.

Total Qty This field contains the total quantity which appear on screen 2 of this shipment.

Total Amt This field contains the total value of this shipment, including freight and miscellaneous charges.

Credit Card If this box is checked it indicates that the order is being paid by credit card.

Processed If this box is checked it indicates the the credit card has already been charged. The credit card is charged when the order is saved based on the shipment status. If the status is set to "N" the user will be asked if the credit card is to be processed. If the status is set to "S" and the card has not already been processed the processing will be done without asking the user. If the credit card has already been processed and the record is deleted a credit will be issued against the card. Changes in the value of the order may also cause credits or additional charges to be added to the credit card.

Freight Taxable Checked if freight is being taxed.

Version 8.10.57