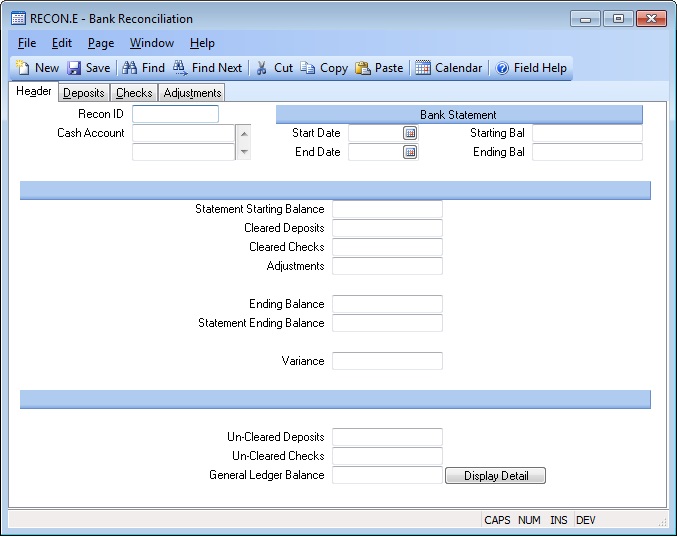

# Bank Reconciliation (RECON.E)

Read Time: 2 minute(s)

# Header

Recon ID If you are peforming a new bank statement reconciliation, leave this field empty. Use this field to review a previous reconconciliation.

Cash Acct Enter the General Ledger account number(s) for the bank account you are reconciling.

Month Start Enter the starting date for the month you are reconciling.

Month End Enter the ending date for the month you are reconciling. This date will also be used as the clear date for cleared transactions.

Bal Start Enter the statement starting balance.

Bal End Enter the ending statement balance for the period being reconciled.

Stmt Starting Bal This field contains the statement starting balance shown above.

Cleared Deposits This field contains the total amount of cleared deposits.

Uncleared Deposits This field contains the total of the uncleared deposits.

Cleared Checks This field contains the total amount of checks cleared.

Un-cleared Checks This field contains the total amount of the uncleared checks.

Adjustments This field contains the total adjustments.

Ending Balance This field is the calculated ending balance from the figures above.

Stmt Ending Bal This field contains the statement ending balance entered above.

Variance This field contains the difference between the statement ending balance and the calculated ending balance.

G/L Balance This field contains the general ledger balance. The balance posted to the general ledger will differ from the bank balance because the g/l balance will include the un-cleared checks and deposits but the bank or statment balance will not include those un-cleared amounts. This field is calculated by subtracting the un-cleared checks and adding the un-cleared deposits to the ending bank statement.

If this field does not reconcile to the general legder (i.e. the trial balance

reports), you should do the following:

1. Verify that all register records have been interfaced to the g/l .

2. Verify that all journal entries have been posted to the g/l. You can run GLTRANS.R2 to view any un-posted transactions.

3. Verify that no additional CASH or CHECK transactions have been made into

the associated period but not referenced on this record. You can do this by

selecting the LOAD NEW DEPOSITS and LOAD NEW CHECK options on the following

tabs.

4. Verify that a journal entry has been made for the amounts referenced on

the ADJUSTMENTS tab.

Display Detail Press this button to show display the detail for the general ledger balance.

Version 8.10.57