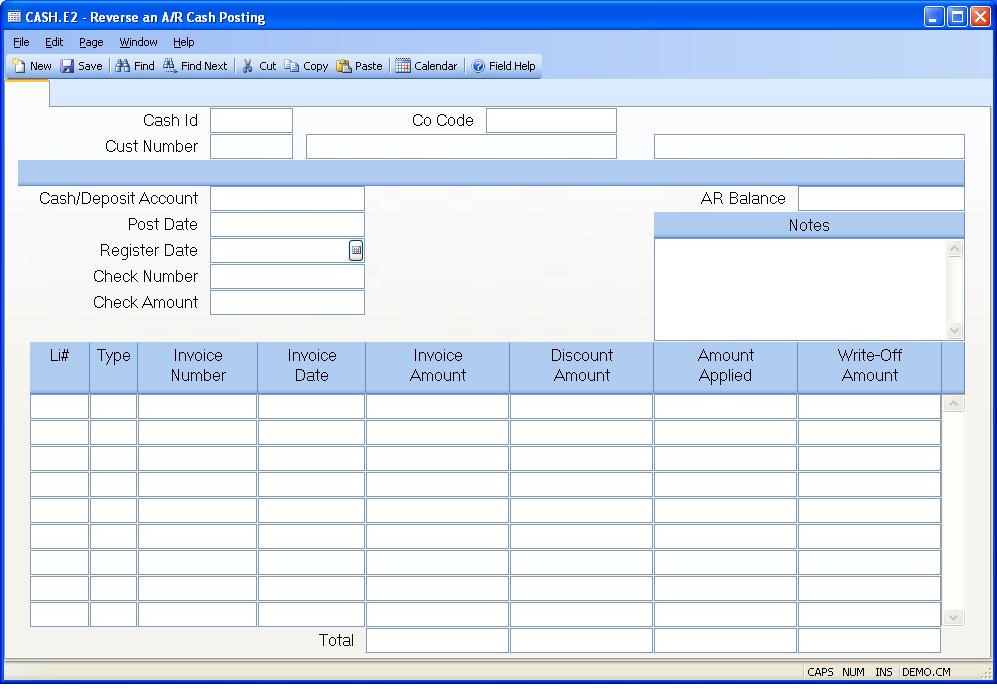

# Reverse an A/R Cash Posting (CASH.E2)

Read Time: 3 minute(s)

#

Cash Id This is a sequentially assigned number used to identify the cash batch you are entering. The number will be assigned and displayed when the record is filed.

Co.Code Company code entered for this cash record.

Cust Number Enter the customer number who is making the payment. The customer name will display for verification as well as a portion of the address.

Cash Account Enter the General Ledger account number to be debited for the cash amount. This number will default from the AR Control record and can be overridden if required.

Post Date Enter the transaction date which should indicate when the payments were applied. This date will be used to calculate any discounts which should be allowed.

Date Reversed The date which will be assigned to ARREG records created by this reversal. If you are correcting a mistake from a previous, still open period, you will want to enter a date in that period.

Check Number Enter the number from the check which the customer is using to make the payment. If you are not applying a check, but are 'netting' invoices, enter any code you wish which will indicate what you are doing.

Check Amount Enter the net amount (face value) of the check. This is the actual amount of money being applied.

AR Balance The field displays the AR Balance before this record is filed.

Li# Enter a line item number which will uniquely identify each invoice being paid. This will be a sequential number.

Type This is the AR type: IN - Invoice CM - Credit Memo OA - On

AR Id The record ID in the AR file of the item being paid. This can be an invoice, credit memo or an on-account record.

Inv Date The invoice date from the AR record.

On Account The amount of the check which was posted as an On Account amount AR item.

Disc Amount The discount amount being allowed for this invoice, base upon the terms and invoice date. This amount is automatically defaulted, but can then be changed as required.

Amount The application amount for this transaction. This field will default to the invoice balance, less discount, provided that the check running balance is sufficient. If not, this amount will default to the remainder of the running balance.

Write Off Amount The amount of the invoice on this line which was written off.

Tot OA Amount The total of all OA amounts on the invoices listed in this column.

Tot Disc Amount The total of all discount amounts allowed.

Total Amount The total of all applied amounts entered.

Total Write Off The total of all write offs entered.

Cust Name The name of the customer, as read from the CUST file.

Address This portion of the address is used to verify you have selected the proper customer.

Notes Contains the notes from the cash receipt being reversed.

Version 8.10.57